|

| Even stock markets have bulls! |

It hurts to see that most of our very profitable companies (which we call 'Indian') are owned by FIIs (Foreign Institutional Investors) and FPI (Foreign Portfolio Investors). For example, more than half of HDFC bank, which is the most valued bank in India and the second most valued bank in the entire world, belongs to foreign investors. Just a few thousand invested in HDFC bank, 20 years ago, would be worth crores by now. Similarly, Indian people have lost billions of dollars of profits, in many companies, to foreign investors. Just because most of the Indian investors invest for short term, they can't hold high-quality stocks for the long term, and thus, most of us aren't able to build wealth in equity markets.

The power of compounding

The human brain isn't wired to process compounding. Our brain can process arithmetic progression. You can quickly calculate the result of adding a number 10 times. But can you calculate the result of growing a number by 15% every year for 30 years? Take a guess.

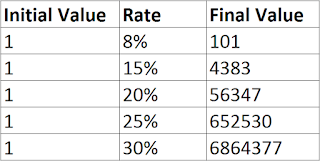

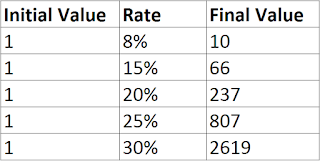

Let's see the result of compounding INR 1 lac at 8%, 15%, 20%, 25% and 30% for 30 years.

You can see that at 8%, which is our current (government bonds, FDs)interest rate and which is going to go down with time, the amount will become INR 10 lacs. If I include the tax on interest, the final value will be very less.

But suppose you get your hands on a stock that grows by 15%, 20%, 25% or 30%. Isn't the contrast between the end results astounding! Increase the time by 30 years more and you won't believe your eyes.

For 60 years.

|

| Compounding for 60 years |

It is the power of compounding. I assure you that it's near impossible to see 30% compounding for such a long time. Even 20-25% compounding is hard. But many Indian companies like Nestle, HUL, Infosys, TCS, Asian Paints, Kansai Nerolac, Apollo Hospitals, ITC, HDFC Bank, HDFC, Kotak Mahindra Bank, etc., have given such kind of compounding in the past. Some of these have given even more than 30% for a specified period of time. And that's why these companies have become so big. But after a certain size, growth starts slowing down, and that is natural.

That's why we should try to spot these companies when they are small in size. But even now, after becoming big some of these businesses will continue giving superior returns compared to fixed deposits and government bonds. The trick is to buy them below their fair value and keep holding on to them. If you pay a very high price(much higher than the fair value), even for the greatest company, you're going to lose money. But I'll come to the concepts of valuation later. For now, let me make you guys familiar with certain terms and ratios used while evaluating a stock.

Stock market jargon

Here are some financial terms you'll encounter while studying financial results of a company.

Accounting period: Financial statements are made for a fixed period. For most of the companies, the annual accounting period is from 1st April to 31st March, and this annual period is divided into four parts of 3 months each, called quarterly periods. Every listed company publishes quarterly results and annual results. They also publish an Annual Report of the business every year.

These are the terms you can find in a typical profit/loss statement.

Sales/Revenue/Total Income: Value of the products sold/ or services delivered during an accounting period.

Operating Profit(OP): Think of operating profit(EBITDA) as profit you get after you cover the costs of running your day to day business like Raw material, Salaries, Maintenance, Marketing expense and other business expenses. So OP it is Sales minus operating costs.

Operating Profit Margin(OPM): Operating profit/Sales. The higher the OPM, the more efficient the business (because it has lesser costs compared to its competitors).

It is also known as EBITDA - Earnings before interest, tax, depreciation and amortisation.

Net Profit: Operating profit - (other costs like Interest paid on debt and depreciation/amortisation of assets) - tax paid for the period

EPS: Earnings per share = (Net Profit)/(No of shares). Suppose the company has INR 10 crore net profit and it has one crore outstanding shares, so its EPS becomes 10/1 = 10/share.

P/E: Price to earnings ratio is (the Current trading price of the stock)/(EPS).

Let's take the above example. Suppose the current price of the stock is INR 100/share and EPS is 10, so the P/E becomes 10. Generally speaking, the lower the P/E, the cheaper the stock price. But P/E ratio, in isolation, can give a wrong picture of the stock. It is a useful tool in comparing a stock to other stocks in the same industry(or comparable).

Now let me give you an example of a profit/loss statement

|

| Income Statement |

The is a snapshot from the Dec quarter result of Hatsun Agro Ltd, A south based dairy products company.

You can see Total Income from operations, amortisation which is 830 crores(For Dec-15), it's also known as sales and revenue.

You can see "profit from operations before Other income and finance costs" which is 43.53 crores. Add to this Depreciation and Amortization expense (27.12 crores) and you'll get Operating profit(EBITDA) which is 70.65. (Note: depreciation and amortisation are not operating costs)

You can see net profit which is 17.55 crores for the dec-15 quarter.

Now for finding EPS, we need to find the total number of shares. You can see share capital, which is 10.87 crores with a face value of INR 1. Just divide the share capital by the face value and you'll find the total number of shares. Total shares = 10.87/1 = 10.87 crores.

So, EPS for the December quarter is 17.55/10.87 = 1.62

You can compare the dec quarter results with the previous quarter results given above and check the growth rate of the company and the improvement in operating profit margins. You can also see the 9 month results(from April to Dec) and you can see that the net profit(EPS) growth is very fast - from 2.83 to 7.11. What do you think is the reason for this EPS growth? Analyze the statement again and give your answer in comments.

P/E ratio can't be determined from quarterly EPS, and we won't know the annual EPS till the march quarterly results are out. But by observing the growth rate in EPS, and by observing the 9 month EPS (which is 7.11), we can make an educated guess of about 9.5 annual EPS. The current share price is 414, so estimated P/E ratio would be 414/9.5 = 43.35. Does this stock look expensive to you?

I think this is enough for now. In the next post, we're going to look at certain Balance Sheet terms. If you've any questions, please feel free to ask.

nice information thanks for sharing valuable content with us we also provide great information related to your blog feel free to visit our trading

ReplyDeleteGreat work ! Thanks for sharing

ReplyDeleteTata Motors Limited Shares

Stock Market

Tata Motors Ltd