|

| A happy dog :) |

Humans are emotional animals. We get easily angered, happy, excited and gloomy over ordinary things. For example, in news channels, we almost always hear the negative news. Even mild incidents are presented in such a way it makes us think that there is nothing except negativity in entire India. They try to make us bitter and angry, and we quickly become bitter and angry. But sometimes when we hear a positive news, we become happy and excited too. A simple report, a simple sentence, a positive quote and a picture can change our emotions completely.

Similarly in stock markets we encounter emotions every day. These emotions, if unchecked, can harm us a lot and the same emotions can be used to our advantage as well!

Bull market and Bear market

When people are confident about the economy and stock markets, then they're willing to pay a higher price for stocks and these stocks (generally) trade at a higher price to their fair value. It is described as a bull market and these confident people are called bulls.

Similarly, when people are negative, then they sell their stocks at a lower price(sometimes much lower than their fair values). It is known as a bear market and these people are called bears.

So sometimes we have a bullish market and sometimes we have a bearish market.

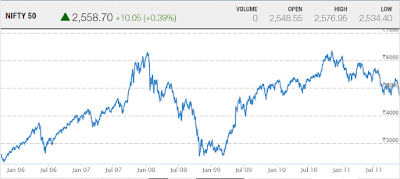

See this chart of Nifty 50 that represents the weighted average price of top 50 companies in India. It is in between 2006 to 2011.

You can see that between January 2006 and January 2008, Nifty is crazily going up. During this period euphoria was rampant in the market. Most of the stocks became highly overvalued. It was an incredibly bullish market.

And then 2008 came and with it came the global recession. Within few months, Nifty went tumbling down from a high of 6000+ to sub 3000 levels. It was an incredibly bearish market. Most of the stocks were trading at far lower prices compared to their fair values.

As you can see that Nifty recovered in a few months, but it took some time for it to achieve its previous high. Nevertheless, if you're a skilled investor, you'd have sold your stocks when the markets were extremely bullish and you'd have bought a lot of shares when the markets were bearish. It's common sense, right? A simple strategy. Wait for the global recession, buy quality stocks in that downturn, and keep holding them till the market becomes extremely bullish again. The human psychology is not so easy to understand.

The psychology of human misjudgement

Do you know that almost all of our decisions are based on what others around us are doing? We like the things our friends like. We like people that our friends like. We select the courses that our friends are choosing. We vote for a political party based on what the crowd around us are doing and the general perception about it. We are vegetarian(or nonvegetarian) because of our families and friends. In fact, we are more likely to do what people expect from us. It is a typical bias, known as Social Proof.

Social proof is a psychological phenomenon where people copy the actions of other around them to reflect the correct behaviour for a given situation.

And this behaviour is also seen in the stock markets.

In a highly bullish market, you'll see people making a lot of money around you. It will be tough at that time to just sit on your ass and do nothing. You'll become jealous of people who are minting money so quickly. It will be very tempting. And one fine day you'll just lose your patience.

Similarly in a bearish market, there will be so much negativity around you that it'll scare you to your core. Everyone you meet would have lost a lot of money. They'll tell you that investing in stocks is gambling. They'll tell you to keep your money in FD. Don't listen to them. They are the same people who'll be the first one to buy stocks in the next bull market.

So if you can't control your emotions and if you can't keep a relaxed mind, both in a positive and negative environment, then stay away from stocks. It's not for you. But if you're one of those rare individuals, who like to use their brain and who have the patience to wait, then you'll make reasonable returns here.

Note: I'm not saying that buy only in a bear market and sell only in a bull market. The right decision depends on individual stocks. You'll find both types of opportunities in both markets.

No comments:

Post a Comment